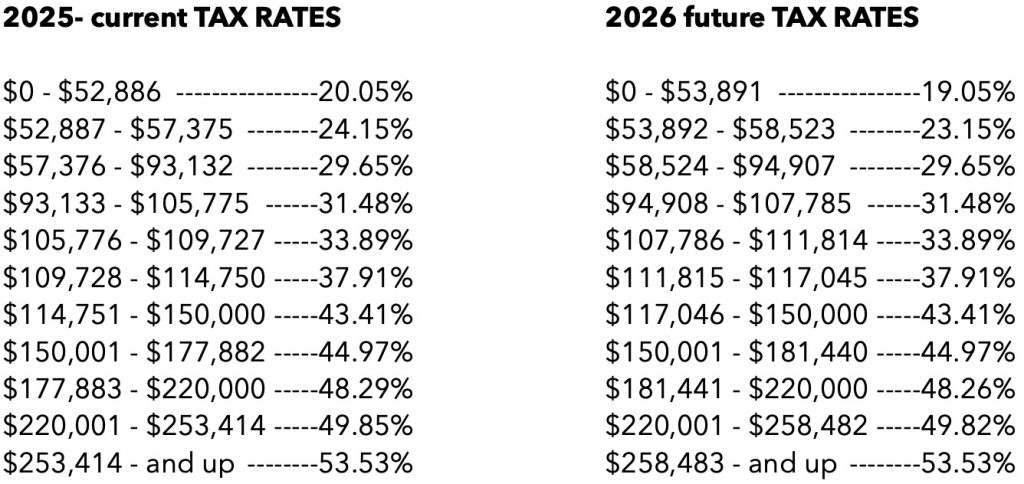

As part of your income tax preparation for 2025 – our service includes a tax planning review; offering simple strategies for future years — taking into consideration the stage of life you are currently in, your estimated future income, current tax rates, RRSP holdings, TFSA holdings, pension splitting, FHSA First Home Savings Account and other government programs.

OAS Age Clawback starts at $44,325 OAS

Social Repayment starts $95,323

Basic Tax Deduction Reduces $160,451